Vietnam Fund Performance Report - December 2025

FiinGroup is pleased to introduce the 2025 & December issue of the “Performance of Investment Funds in Vietnam” report, this report aims to provide clients with up-to-date insights as well as a comprehensive overview of fund performance and capital flows in Vietnam’s stock market.

Key highlights of the report include:

- Equity funds delivered solid average return in 2025, broadly in line with their medium- to long-term historical performance. However, it notably underperformed the VNINDEX, as market gains were concentrated in a limited number of large-cap stocks. Meanwhile, bond funds continued to post stable returns, largely tracking movements in deposit interest rate.

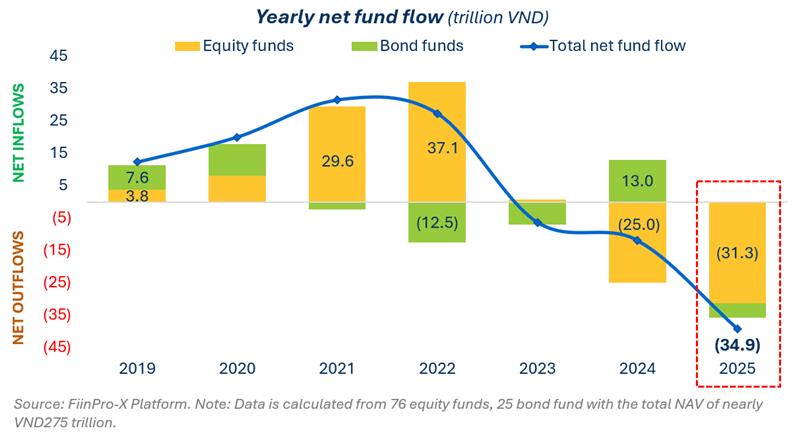

- Investment funds showed record net outflows in 2025, largely reflecting profit-taking and portfolio rebalancing amid changing market conditions. Outflow pressure was mostly recorded in equity funds, marking the first year in which open-ended funds, closed-end funds, and ETFs all experienced net redemptions. Bond funds also saw a reversal in capital flows, shifting to net outflows after a year of strong inflows in 2024.

- Most large funds increased cash holdings in December 2025, signaling a more defensive positioning and heightened caution among fund managers.

- Portfolio reallocation was most visible within the Banking sector with increasing exposure to VCB, CTG, MBB, and VIB (in which VCB, VIB underperformed the sector), while reducing positions in VPB, TCB, STB, and SHB, which experienced strong price gains. In addition, ACB and TPB recorded net selling by funds, despite relatively stable share price performance movements.

Figure: Record net outflows in 2025, mainly driven by profit-taking and portfolio rebalancing

👉 For more detailed information, please download the full report HERE

The Investment Fund Activity Report is a monthly publication by FiinGroup designed to deliver an overview of fund performance in Vietnam.

Source: Data and insights are extracted from FiinPro-X.

Learn more about FiinPro-X: https://fiingroup.vn/en/fiinpro-x.html

Tags:

Highlights

Đang tải xác thực...