Methodology

Methodology

This rating methodology explains FiinRatings approach to assessing credit risk of non-financial corporates in Vietnam. This methodology is intended as a general guidance to help companies, investors and other market participants to understand how FiinRatings looks at quantitative and qualitative factors significant in explaining rating outcomes in this sector.

The methodology is driven by a scorecard, a simple representation of the relevant data and how it is combined. The scorecard is used by the RatingPlus’ analysts and by the Rating Committee to assess the creditworthiness of a non-financial corporate issuer in Vietnam. However, the scorecard is just a reflection of a framework (and not a model) and thus cannot and does not incorporate or consider every rating consideration. This is especially true for the more qualitative factor scores that are denominated as adjustment factors to the qualitative factor scores. The weights for the factor scores and qualitative adjustments shown in this document are for reference only and their importance may vary substantially.

In addition, ratings are forward-looking opinions about an issuers’ future capacity and willingness to honour its obligations to creditors, but the scorecard uses historical data. As a result, the assigned rating may deviate from the scorecard-indicated rating range in such cases, where a rating committee deems this to be appropriate.

This methodology is used to assess the creditworthiness of non-financial corporate issuers in Vietnam.

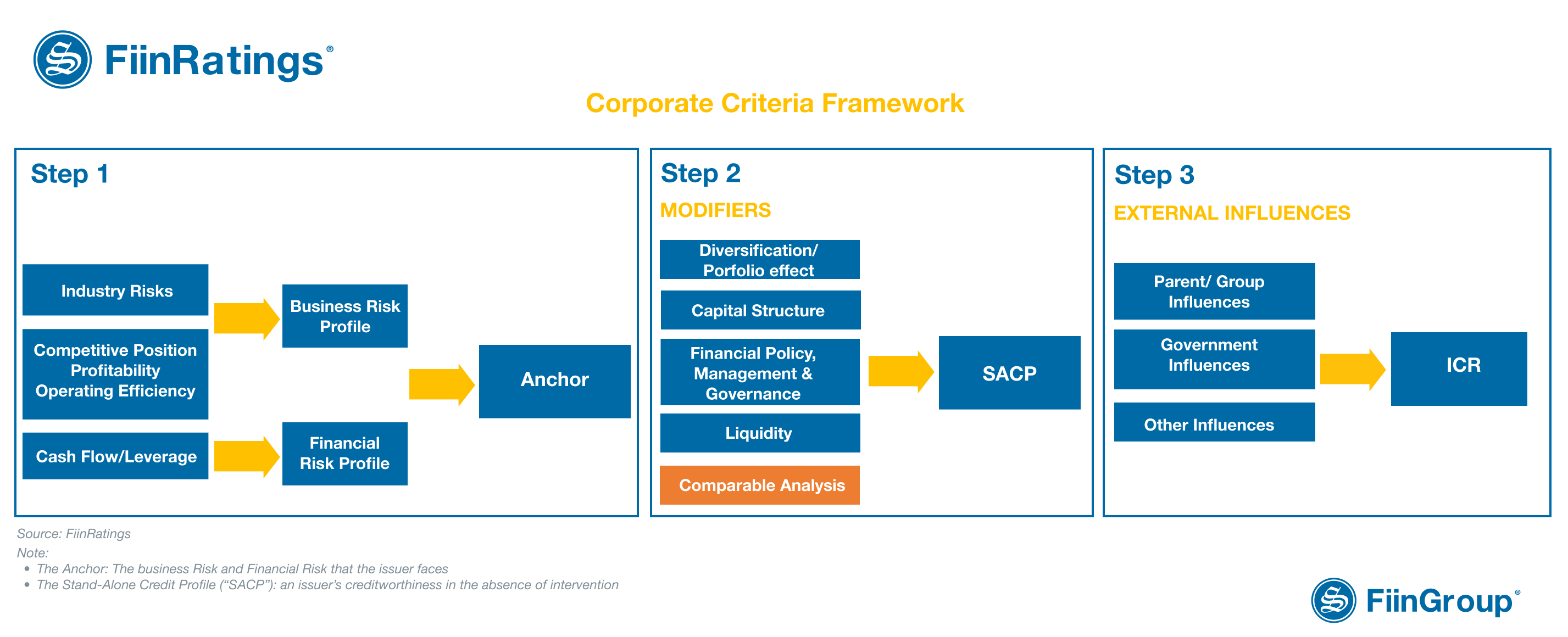

Corporate Criteria Framework

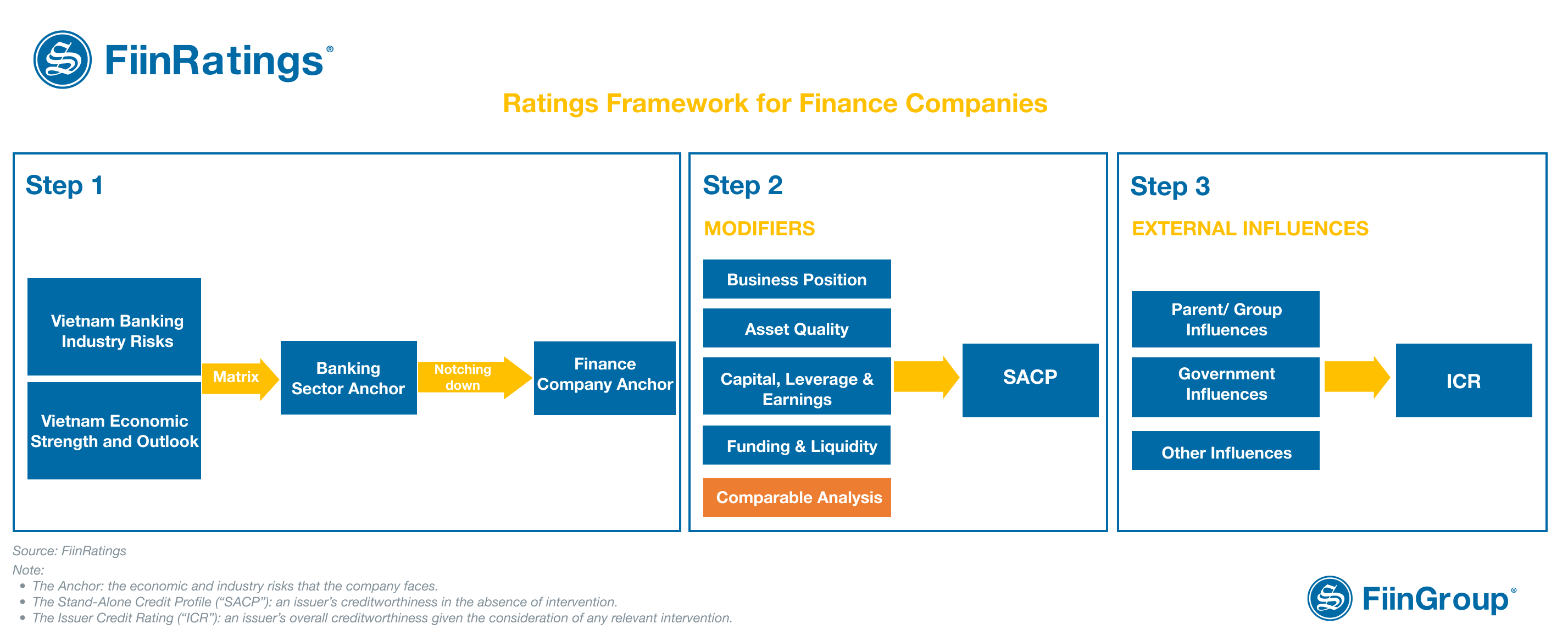

Financial Institution Criteria Framework

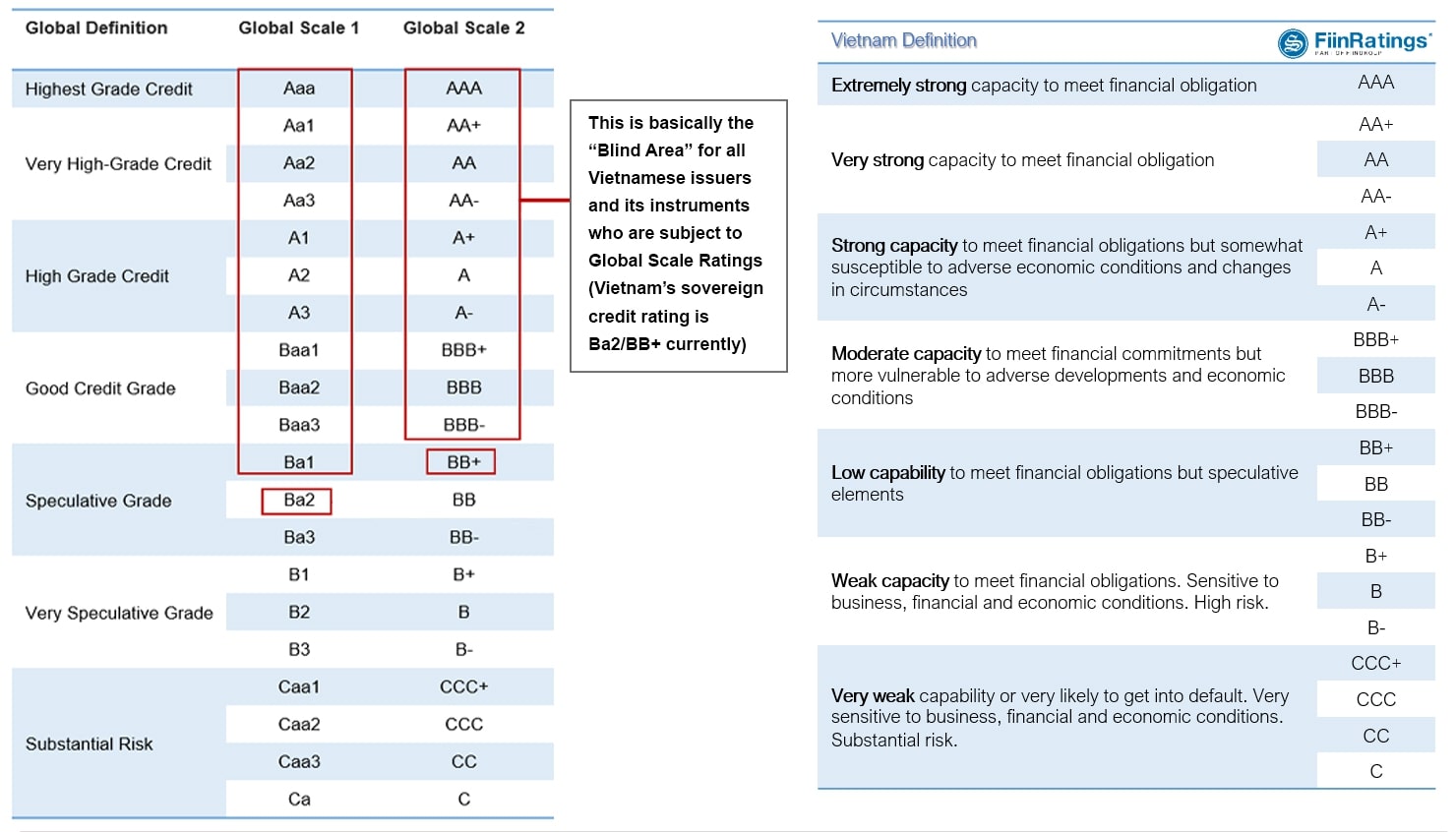

Learn more about Rating Symbols and Definitions Learn more.

Corporate Credit Rating Methodology Learn more.

Non-Bank Financial Companies Learn more.

Securities Companies Credit Rating Methodology Learn more.

Banks Rating Methodology Learn more.

Notching for Group Suppport Methodology Learn more.

Policy on Definition and Recognition of Defaults Learn more.